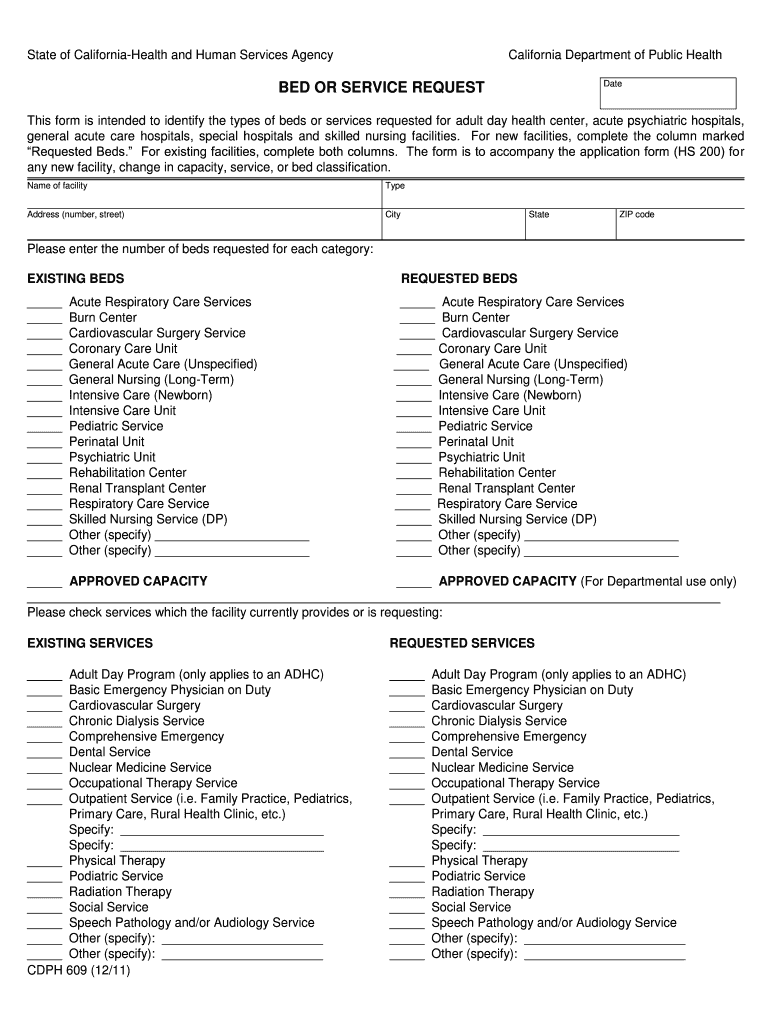

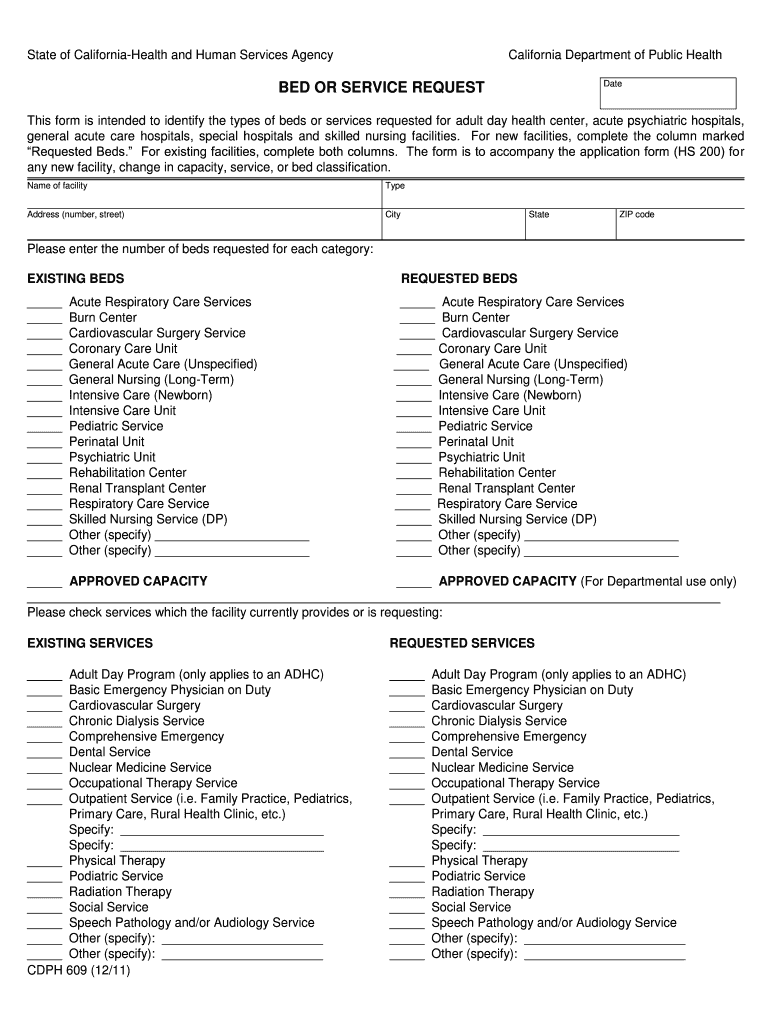

CA CDPH 609 2011-2024 free printable template

Get, Create, Make and Sign

Editing form 609 online

How to fill out form 609

To fill out form 609, follow these steps:

Video instructions and help with filling out and completing form 609

Instructions and Help about allocation form

This is Stacy like millions of Americans her credit report is less than perfect she's tired of getting turned down for loans paying high interest rates and not being able to rent without a cosigner because of her low credit score Stacy decides to clean up her credit report she considers hiring a credit repair agency who'll charge her $800 to electronically submit a dispute to each of the credit agencies saying that the debts are not valid then the credit reporting agency contacts the original creditor and asks to verify the debt electronically if they don't hear back in 30 days then they remove the account from Stacey's report sounds easy right except for two problems first the debts usually reappear on the credit report within six to twelve months, so Stacy is out the $800 and even more importantly it's perjury to lie and say that a debt on your account isn't yours Stacey doesn't want to do that but doesn't know what other options she has is there a way she can legally get accounts off her credit report once and for all there is we are 609 disputes calm we can show you how to use a proven method using a little-known federal law that can legally get accounts removed permanently did you know that under the Fair Credit Reporting Act all unverified accounts must be promptly deleted from a consumers credit report but what is a verified account a verified account is one where the credit reporting agency has your original signed paperwork in their physical possession otherwise they can't report it on your credit file but the three big credit reporting agencies don't do this they do not keep original copies of your documents in their possession here's how it works American Express electronically submitted information to the three credit reporting agencies saying that they've sent Stacey's account to collections then the credit bureaus put that on her report except according to the Federal Trade Commissioner because they don't have Stacey's original signature these agencies are not complying with federal law and must remove items upon demand from the consumer experience acts and TransUnion do not store any original signatures and thus must remove all items listed on her credit report upon request with our do-it-yourself credit dispute letter package we will provide you letters to send to all three credit bureaus where all you have to do is input your personal information and list up to 22 items you demand to be legally removed we even provide you with three follow-up letters for each agency 12 letters total in addition to step-by-step instructions to walk you along each step our letters use existing federal laws and regulations and have a 90% or higher success rate we provide email support for all questions and a 100% money-back guarantee to learn more about how Stacey and many others have legally removed both valid and invalid negative items from their credit report permanently and how you can do it also enter your email address below to receive our...

Fill how to cdph 609 : Try Risk Free

People Also Ask about form 609

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form 609 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.